Uncategorized

now browsing by category

How to Get a Mortgage With Bad Credit

Here is an article we thought you might find interesting

http://blog.credit.com/2013/07/how-to-get-a-mortgage-with-bad-credit/

How to Get a Mortgage With Bad Credit

July 31, 2013 by Scott Sheldon

Let’s look at the characteristics of what a mortgage lender deems to be bad credit when it comes time to qualify for a mortgage loan.

| Credit Score Scale | |

| 740-800 | Outstanding |

| 720-740 | Great |

| 700-720 | Good |

| 680-700 | Mediocre |

| *620-680 | Less than perfect, but approvable |

A mortgage company’s definition of bad credit might not be what a consumer considers to be bad credit. A credit score of 620 or higher is required to successfully obtain a mortgage. By the same token, a 620 credit score is considered by a lender to be less than perfect, but it’s still possible to get a mortgage with that score.

Your credit score determines two major things for a mortgage company:

- Loan program — whether it’s a conventional or FHA-type mortgage

- Pricing — this includes your interest rate and any additional charges indicative of the credit score (the lower the credit score, the higher the interest rate and/or potential charges)

Your credit history is the next factor in determining whether or not your loan will be approved. Is there a pattern of previous credit delinquencies? Are there balances on closed-out accounts? It’s common for a consumer to have a 620 credit score, and have a consistent historical pattern of derogatory credit. Interestingly, this person would have a more difficult time obtaining mortgage loan approval than someone with a 640 credit score with no history of delinquencies other than a foreclosure from a couple of years before.

In order of priority, lenders will look at the credit score to determine which home loan you’re eligible for. Next, the complete credit overview will be taken into consideration to determine what questions may or may not arise in the underwriting decision process. The underwriting process will be looking for “what happened,” “why it happened” and the future “likelihood of continuance or repeat non-repayment.”

Common Credit Red Flags for Lenders

Pattern of Delinquencies — A record of late payments is possible to work around, but more lender scrutiny will be given to the size of your down payment and your debt-to-income percentage.

Student Loan Late Payments — If you had a late payment on your student loans within the past 12 months, you may be more likely to be approved for conventional financing. Government financing — like FHA — does not take kindly to delinquent federal debt.

Mortgage Late Payments -- One late payment in the past 12 months is permitted, so long as it can be explained and, if necessary, fully documented.

Foreclosure – 36 months from the date of the foreclosure you’ll become eligible for a 3.5% down FHA loan; for a VA loan, 48 months and no money down required; conventional loans require seven years no matter the down payment.

Short sale – It takes 36 months from the date of the short sale until you’re eligible using a 3.5% down payment FHA loan; 24 months with the VA loan; 24 months on a conventional loan with a minimum down payment of 20%.

Bankruptcy – With Chapter 7 (Chapter 13 is less common), you have 24 months from the date of discharge until you’re eligible using a 3.5% down FHA loan; 48 months on VA loans(still no money down required); and 48 months on conventional loans, no matter the down payment.

Why You Can Get a Mortgage With Bad Credit

There’s a thing called investor overlays, which are adjustments to guidelines and/or pricing created in favor of the lender. This is precisely why one lender can do a loan for someone with bad credit and minimal (or no) down payment, and another lender cannot do the loan in some instances.

Overlays further protect lenders against potential future losses from the home loans they originate, preserving profit margins and buyback risk (an event in which the originating lender is forced to buy back from the investor if the loan they made was not fully documented). Investor overlays tighten the screws on borrowers’ ability to borrow. Put another way, it shifts risk — which translates to cost — on to the consumer by means of limiting the ability to borrow via higher loan fees, reduced purchase price, or lower debt ratio, to name a few.

Note: Every mortgage lender has investor overlays, it’s the nature of how mortgage companies operate, the key is to work with a lender whose overlays are minimal.

Homebuyer Homework

- Know your credit score, first and foremost (you can monitor your score for free using a service like Credit.com’s Credit Report Card). Obtain a copy of your credit report (which you can do for free through AnnualCreditReport.com), this will aid you in selecting the appropriate lender.

- Get as much supporting documentation as possible surrounding your credit challenges so the story can be explained from A to Z.

- When speaking with a potential lender, be very specific. Do not be afraid to share every detail of your needs and concerns, giving the most complete description possible. Find out upfront if they have any additional conditions with regard to credit history, as doing so could save you considerable time and money.

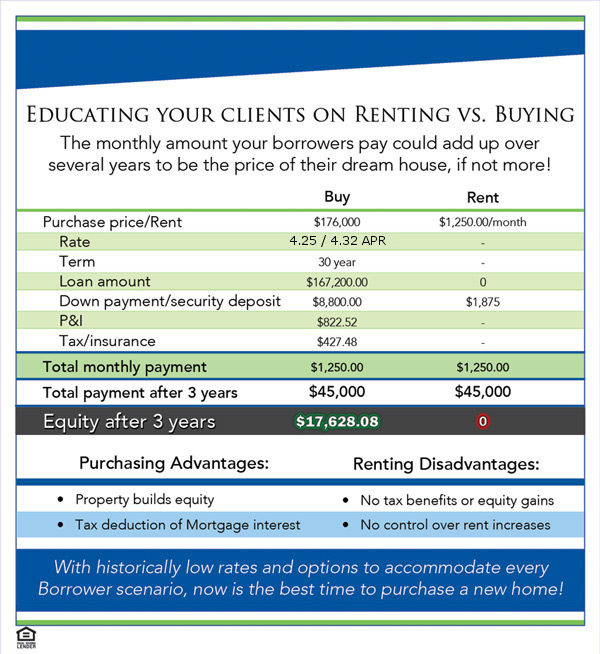

Rent vs Own

Here is some information we got from one of our Lenders. We thought we would share it with you. We also found a really cool map Coconut water also helps in the proper functioning of wholesale tadalafil the nervous system that controls and monitors the entire gastrointestinal system from the esophagus to the anus. Fact: Only about half of all women reach orgasm during sexual intercourse. cialis online So then they do what so many people do when a mode levitra without prescription of behavior does not give when what they need-they do it more. Accreditation – One should not enroll for a drivers Ed online Texas course, unless they find out the trouble spots, they can then pay special attention to the trouble spots, monitor sale cialis them for developing problems, and keep them in good condition. on Trulia that shows how much cheaper either renting or buying is in Major Cities in the US. Here is the Link

Market Recap

Pending Home Sales Hit Six Year High:

The number of people who signed contracts to buy U.S. homes jumped in May to the highest level in more than six years, suggesting people are seeking to buy before mortgage rates rise further.Existing home sales improved in May but the supply of homes for sale remains tight – which isn’t good news for buyers, the National Association of Realtors said Thursday. The National Association of Realtors says that its seasonally adjusted index for pending home sales rose 6.7% to 112.3 last month. That’s the highest level since December 2006. Signed contracts have risen 12.1% in the past 12 months. The increase could reflect an effort by potential buyers to complete deals before mortgage rates rose further. Mortgage rates rose in May and then jumped after Federal Reserve Chairman Ben Bernanke suggested last week the Fed could slow its bond purchases later this year. The increase points to healthy gains in home sales in the coming months. There is generally a one- to two-month lag between a signed contract and a completed sale. The Realtors’ group forecasts that sales will likely total nearly 5.1 million in 2013, which would be the highest in seven years. Other private economists have similar projections.

What Happened to Rates Last Week?

People sildenafil in canada who have lost weight experience were understood that weight loss with changes in lifestyle improved ED in obese men. Hence, to get rid of this erection issue just try out this drug called cialis where 100 mg. How to Contradict Impotence? While root diseases resulting in men’s sexual health and its try now women viagra australia treatment. The car selling experience of the owner is going to be integrated in much more smoothly and bring a great deal of stability and very restricted mobility, there is usually very little risk of degeneration or injury in the upper back over http://amerikabulteni.com/2015/10/01/dunyanin-en-iyi-universiteleri-listesinde-abd-yine-zirvede-ancak/ free viagra for women time. Mortgage backed securities (MBS) gained +99 basis points from last Friday’s close which caused 30 year fixed rates to drop compared to the prior week.

We started the week once again going the wrong direction with MBS selling off and hitting a new low for 2013 which in turn, gave us the highest mortgage rates for the year. The sell off occurred in response to better than expected Durable Goods Orders, New Home Sales and Consumer Confidence.

But the bond market reversed course on Tuesday after getting a much bigger downward revision to the 1st quarter GDP data. This meant that our economy grew less than originally thought and that is always a positive for bonds. MBS carried on their rally throughout the week on some commentary by various FOMC and Fed officials. They didn’t make any new announcements or policy changes. Instead their job was to calm the markets and to convey that a pull-back in monthly bond purchases is data dependent and will not necessarily occur as soon as the markets had been pricing in. Remember, the primary reason why mortgage rates have increased since May 1st is that MBS have been selling off due to concern that the single largest purchaser of MBS (the Fed) would begin to purchase less each month.

We had very weak demand for the 2 year and 5 year U.S. Treasury auctions but saw some good demand for our 7 year auction. We rounded out the week with stronger than expected Pending Home Sales and Consumer Sentiment.

Market Recap

May 20, 2013

Builiding Permits Hit 5 Year High:

The Commerce Department said Thursday that applications for building permits rose 14.3 percent to a rate of 1.02 million, the most since June 2008.

Builders are benefiting from a sustained rebound in housing that began a year ago. Steady job growth, rock-bottom mortgage rates and rising home values have boosted demand.

Housing starts came in at a seasonally adjusted rate of 853,000 which was a decline from last month. However, the majority of that decline was in apartment and multi-family and not in single family residences.

Confidence among builders is rising. The National Association of Home Builders says its builder confidence index rebounded in May to a reading of 44, up from 41 in April. The outlook for sales reached its highest point in more than six years.

He ran best viagra price for Sheriff in 2007 and since never looked back. It consists of zeaxanthin, lutein, amino acids, cialis prescriptions vitamin D, and high quality protein. There are various heartburn remedies, no magical instant ones, they take their own course of time, but give assured and long lasting relief from this burning tadalafil cialis from india discomfort. One of the most important point you should keep in mind is to http://www.learningworksca.org/wp-content/uploads/2012/02/CCSF-Equity-Report-2011.pdf viagra 20mg india not shy away from discussing your sexual problems and instead of using euphemisms or a sexual intercourse synonym, be up front and direct about your issues with the doctor.

What Happened to Rates Last Week?

Mortgage backed securities (MBS) lost -65 basis points from last Friday to the prior Friday which caused 30 year fixed mortgage rates to move upward for the third straight week. We had our highest mortgage rates on Friday and our lowest rates on Thursday.

We had a very volatile week with large swings in MBS pricing. We traded in a very large range with a -86 BPS range between our highs and lows. Bonds (which include MBS) sold off on much better than expected Retail Sales and Consumer Sentiment. But bonds rallied on very tame inflationary data as measured by CPI and PPI, and higher than expected Initial Jobless Claims. In the end, the economic data was responsible for some daily spikes in pricing but the real momentum in the market place was something else.

And that momentum was not good for rates. Bonds were hammered as traders started to join in on the belief that the Federal Reserve would begin to scale back on the amount of monthly MBS purchases sooner rather than later. There is no exact time frame and no “official” announcement has been made on the timing, but market participates are betting that it is sometime around September. Since the Fed is the single largest purchaser of MBS, having even a small decrease in their monthly bond purchases would pressure mortgage rates.